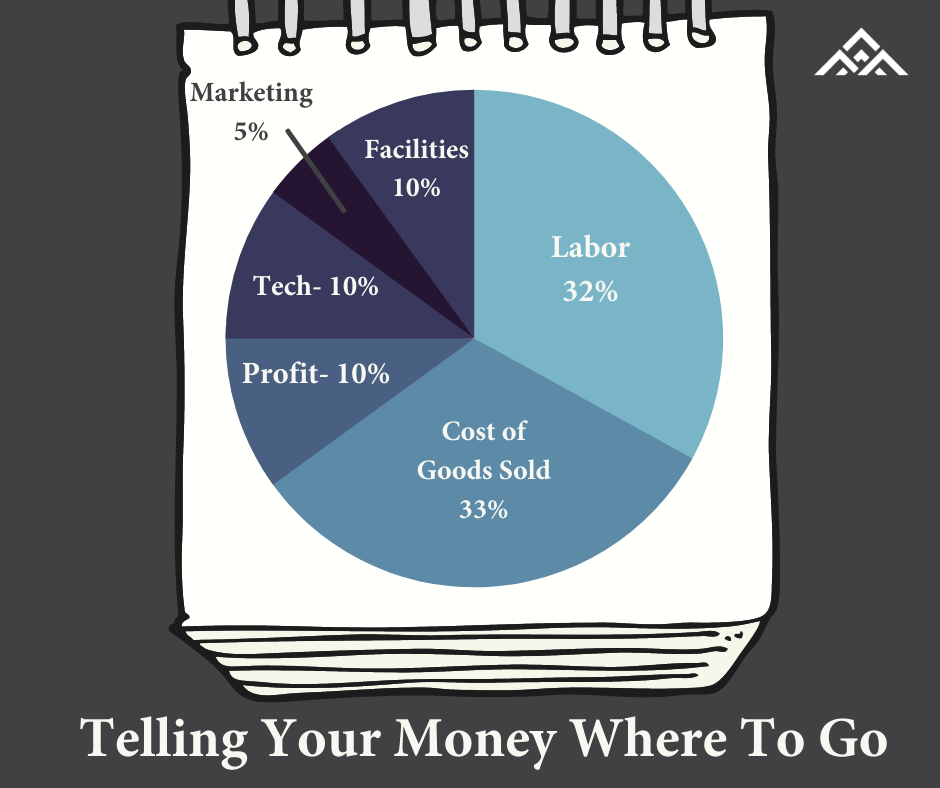

Recommended Percentages for a Profitable Year

Would you start building a house without the blueprints? Then why would you start out the year not knowing where the money that comes into your business will go? Your business could easily have $200,000 to $2,000,000 or more flow through its bank accounts this year. Do you have a plan for where it will go? If you fail to plan, plan to fail.

Annual planning is the solution to this. We want to sit down and consciously determine what will happen to money once it comes in the door. Follow these steps to success:

1. Download your Profit and Loss By Month Report from the prior year into Excel. Use this as a reference to build upon.

2. Use a “Top Down” approach.

- Sales – What are your expectations for this year? Will you be adding customers? Raising prices? Scaling back? Add it to your forecast.

- Cost Of Goods Sold – Consider your costs from the prior year. It is recommended for Product-based businesses that your Cost of Goods Sold be approximately 33% or less of your revenues. How are you doing? If you don’t sell a product, you can disregard this section.

- Payroll Expenses – After Cost of Goods Sold, this is often the largest segment. If you are service based, this could easily be a 30 – 60% of your revenues. When considering payroll expenses, make sure to include things like accrued payroll pay outs, benefits, bonuses, commissions, fringe benefits and more. Will you be awarding raises to your employees this year? Make sure to include it. According to the Bureau of Labor Statistics, the annual inflation rate in 2021 was about 5%. To aid in employee retention, this should be considered in your payroll budget.

- Facility Expenses – This includes items like rent, utilities, repairs and maintenance. Keep these costs as low as possible while still delivering a quality experience to your customers. We typically see these around 5 – 10% of revenues.

- Technology Expenses – Wow, these expenses add up fast! And they are often a place owners forget to keep tabs on. Do an audit on all the software subscriptions that you and your employees have. Determine if they are all necessary and cut any that aren’t. Create a policy for what hardware is necessary when new hires are added to your team (for example, a laptop, 2nd monitor and cellphone) and when hardware is replaced (every two or three years) You don’t want to replace items constantly, but you also don’t want to wait until hardware is so outdated that you are losing out on productivity. A hint to getting more longevity out of your hardware would be an annual or bi-annual computer tune up from a local computer repair shop to keep your equipment running optimally. Small businesses will often spend 5 – 10% of revenues here.

- Marketing – The average, small sized US business will spend about 1.08% on marketing expenses. But this varies greatly by industry and your objectives. If you are a new business trying to ramp up sales, I would earmark around 5%. If you are a B2C, retail type business, you could need to spend up to 10 – 20%. According to a 2021 survey of Chief Marketing Officers from WebStrategies, the “Marketing budget as a percent of total revenue can vary dramatically by industry. While the B2C product sector devotes an average of 13.7% of revenue to marketing budgets, the B2B product sector reports a much lower 6.7% of revenue dedicated to marketing spend.”

- Profit – Last, but definitely not least, your bottom line number. A good goal to start with would be around 10 – 20% of revenue would become profit. If you get to the bottom of your spreadsheet and your profit is less than this, start going back and making adjustments to reach your goal profit number. Be realistic and prioritize your spending. In the early investment stages of your business, work towards the 10 – 20% number slowly, trying to increase your profit each year, perhaps by 1 or 2 percentage points. Check out what average profit percentages are for your industry by researching industry associations (like the National Association of Home Builders, National Restaurant Association or American Animal Hospital Association). These associations also often have financial guides you can purchase to use for benchmarking.

Overall, your business is unique. Make adjustments to these rules of thumb based on your goals. But, no matter what you do, get it in writing before you spend that money. Don’t let your money happen to you. HAPPEN to your money.

Leave a comment